In an era dominated by digital transactions and interconnected systems, the specter of fraud looms large over businesses. As financial transactions and online activities become more prevalent, fraudsters continually evolve their tactics, necessitating advanced tools to counter their efforts. This is where data science emerges as a formidable ally. In this article, we delve into how data science plays a crucial role in fraud detection, offering a powerful shield against deceptive practices and safeguarding the integrity of financial transactions.

Understanding the Landscape of Fraud

Fraud comes in various shapes and sizes, from credit card fraud and identity theft to online scams and insider threats. Traditional methods of fraud detection often rely on rule-based systems that flag transactions or activities based on predefined criteria. However, these approaches have limitations, struggling to adapt to the dynamic and sophisticated nature of modern fraud.

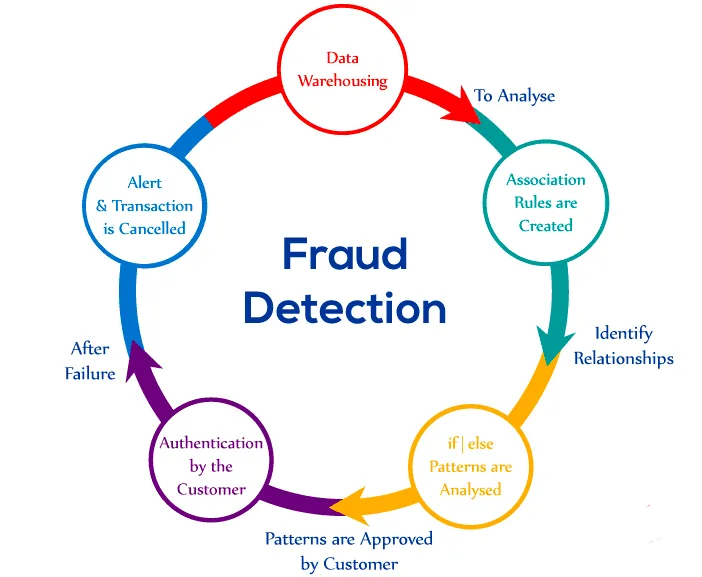

Enter data science – a discipline that leverages advanced analytics, machine learning, and statistical modeling to extract meaningful insights from vast datasets. Let’s explore the key ways in which data science transforms the landscape of fraud detection.

1. Anomaly Detection with Machine Learning

One of the hallmark applications of data science in fraud detection is anomaly detection through machine learning. Machine learning models can be trained on historical data to understand the normal patterns of behavior within a system. Any deviation from these established norms is flagged as an anomaly, potentially indicating fraudulent activity.

For instance, in credit card transactions, machine learning algorithms can learn typical spending patterns of individual users – including transaction amounts, locations, and frequency. If a transaction deviates significantly from these patterns, the system may raise an alert, prompting further investigation into potential fraud.

2. Behavioral Analysis and Pattern Recognition

Fraudsters often leave subtle traces in their behavior that can be detected through meticulous analysis of user interactions and transactions. Data science allows for sophisticated behavioral analysis and pattern recognition, identifying anomalies that might go unnoticed through traditional methods.

By examining user behaviors, such as the time of day a transaction occurs, the device used, or the geographical location, data science models can establish a unique behavioral fingerprint for each user. Deviations from these established patterns can trigger alerts, helping organizations spot potentially fraudulent activities.

3. Real-time Monitoring and Decision-making

The speed at which fraudulent activities can occur demands real-time monitoring and decision-making. Data science enables organizations to implement systems that can analyze and respond to events as they happen, reducing the time window for fraudulent activities to go undetected.

In real-time, machine learning models can assess the risk associated with each transaction or user interaction. If a transaction exhibits characteristics indicative of fraud, the system can intervene immediately, such as by triggering additional authentication steps or blocking the transaction altogether.

4. Combining Multiple Data Sources for Holistic Insights

Fraud detection becomes more potent when it considers a diverse range of data sources. Data science facilitates the integration of information from various channels, such as transaction logs, user profiles, device information, and even external data sources.

For example, combining transaction history with geolocation data and IP addresses can provide a more comprehensive view of a user’s typical behavior. If a transaction originates from an unusual location or an unfamiliar device, it raises the suspicion level, triggering a closer examination.

5. Adaptive Machine Learning Models

One of the challenges in fraud detection is the adaptive nature of fraudulent activities. Fraudsters are quick to evolve their tactics, requiring detection systems to adapt in real-time. Data science enables the creation of adaptive machine learning models that continuously learn from new data and adjust their algorithms accordingly.

These adaptive models evolve with the changing landscape of fraud, ensuring that detection mechanisms stay one step ahead of fraudsters. This dynamic nature is crucial in the ongoing battle against increasingly sophisticated and innovative fraudulent tactics.

6. Social Network Analysis for Linking Entities

Fraudulent activities often involve networks of interconnected entities, such as individuals, accounts, or devices. Social network analysis, a technique employed by data science, can reveal hidden relationships and connections within vast datasets.

For instance, in financial fraud detection, social network analysis can unveil relationships between seemingly unrelated accounts that share commonalities, such as IP addresses, phone numbers, or transaction patterns. Identifying these connections allows organizations to unravel complex fraud schemes.

7. Sentiment Analysis in Online Transactions

In the realm of e-commerce and online platforms, sentiment analysis can be a valuable tool for fraud detection. Data science models can analyze user reviews, feedback, and social media interactions to gauge the sentiment associated with particular transactions or users.

Unusual sentiment patterns, such as a surge in negative reviews following a set of transactions, can be indicative of fraudulent activities. Sentiment analysis adds a layer of contextual understanding to fraud detection, contributing to a more holistic and accurate assessment.

8. Enhancing Decision-making with Explainable AI

While machine learning models offer powerful predictive capabilities, the lack of transparency in their decision-making process can be a concern. Explainable AI, a facet of data science, focuses on providing clear explanations for the decisions made by machine learning models.

Explainable AI is crucial in fraud detection scenarios where understanding the rationale behind a flagged transaction is essential. This not only improves the interpretability of results but also allows human analysts to make more informed decisions based on the insights provided by the model.

Conclusion: A Dynamic Defense Against Deception

In the ever-evolving landscape of fraud, data science stands as a dynamic and adaptive defense against deception. By leveraging advanced analytics, machine learning, and sophisticated modeling techniques, organizations can fortify their systems and stay ahead of cunning fraudsters. From anomaly detection and behavioral analysis to real-time monitoring and social network analysis, data science empowers businesses to not only detect fraud but also understand its intricacies and patterns.

As technology continues to advance, so too will the capabilities of data science in fraud detection. The ongoing synergy between human expertise and data-driven insights is key to maintaining a robust defense against the ever-shifting tactics of fraudsters. In the realm of data science, the fight against fraud is not just a battle; it’s a dynamic and evolving strategy that ensures the integrity of financial systems and online interactions. The Advance Data Science Course by 1stepGrow is a perfect solution for those looking to deepen their expertise in this area.