People are constantly finding ways to innovate technology and make activities more convenient with modern tools. Because of easier access to the internet and the availability of mobile devices, more and more people prefer digital means over in-person processes, including financial transactions.

Like most industries, the financial sector has increased its online and mobile utility to keep up with changing trends and practices. Banking firms implement websites and mobile apps integrated with security features to provide customers with safe and convenient access to their services.

These digital platforms expedite sales, payments, and wire transfers. Moreover, they also provide clients the option to open an account online if they meet the financial institution’s requirements.

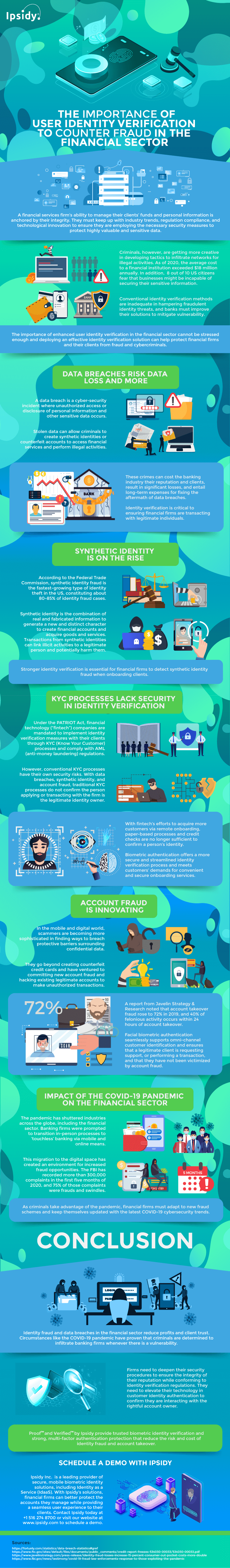

However, with this increasing reliance on technology, banks are becoming more susceptible to new fraud methods, especially if they are implementing weak security measures. Criminals often take advantage of vulnerabilities in the system to perpetrate their illegal activities.

Conventional authentication methods like Know Your Customer (KYC) often require customers to answer security questions or provide information to previous transactions to confirm if they are the legitimate account owner. These validation procedures grant access to account holders based on their ability to provide the required data.

Fraudsters often try to cheat these outdated identification processes by providing stolen information from other users. Sometimes, they try to hack into existing accounts to use them for unlawful acts.

Even with the COVID-19 pandemic, cybercriminals are still persistent in carrying out illicit motives.

With the inconvenience of face-to-face processes amid the current global crisis, people are further increasing their online and mobile usage. This surge in digital financial activities has opened more opportunities for fraud.

As of September 7, 2020, the Federal Trade Commission reported that Americans had lost about $134 million because of COVID-19-related fraud. Scammers target funds related to COVID-19 relief, such as government stimulus and unemployment benefits, among other things.

With these rampant fraud cases, financial firms are driven to improve their security measures, especially amid the pandemic.

As criminals are using technology for fraudulent schemes, companies must adapt and utilize modern tools to counter these security threats. Traditional authentication processes must be replaced with more reliable and advanced solutions to prevent bad actors from circumventing the system.

Moreover, financial institutions must implement dependable validation methods for due diligence to identity verification regulations.

Technological solutions like mobile facial biometrics allow firms to securely authenticate the identity of an individual trying to gain access to their financial services. These modern verification tools implement useful features and controls to block fraudulent attempts. Mobile facial biometrics solutions integrate liveness detection to determine the legitimacy of an identity owner in real-time.

By onboarding trusted user identity verification technology, firms can guarantee that the funds, assets, and valuable information entrusted to them are kept safe and secure. Also, this improved security measure can help financial institutions strengthen consumer trust and increase revenue.

To know more about the importance of implementing reliable customer authentication processes in the financial sector, an infographic by Ipsidy is provided below.