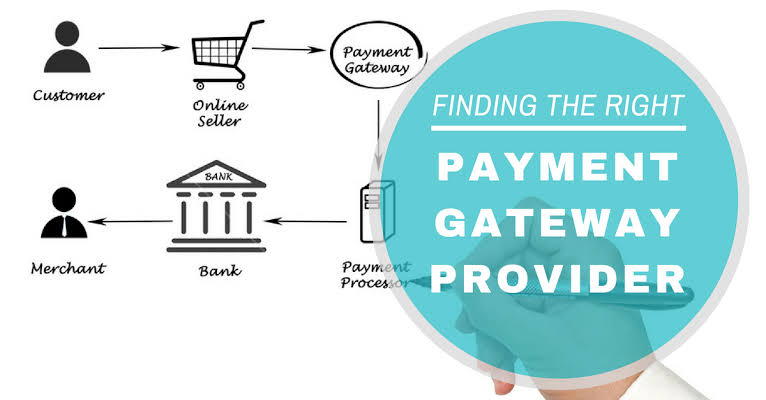

The exponential rise of the e-commerce industry in recent years demands a better and secure payment gateway. This helps the e-commerce company process online transactions easily. The integration of a payment gateway into the e-Commerce platform helps the company to collect the payment via the customer’s preferred bank without compromising sensitive data.

As more customers are shifting to online retail stores to make purchases conveniently, credit cards have emerged as one of the most important tools to secure payment. The credit card payment is forecasted to reach $1.82 trillion in annual volume by 2024. The payment data is sent through a complex web of stakeholders, like the card networks, issuers, and gateways, to complete the transaction. Hence, it is important to select a secure payment gateway to process a transaction efficiently.

Before selecting the best enterprise payment gateway for your business, you need to assess certain important factors. Most of the online payment gateway service providers offer a complete all-in-one solution. This includes payment acceptance, data reporting, and fraud management.

This article lists down ten essential factors that you should consider while choosing a payment gateway provider.

Choose An Appropriate Payment Flow

The e-Commerce payment gateway should be compatible with the growth of your company. Determine the type of payment flow you need for your website. You can choose an integrated payment system that will direct the information to a secure payment gateway through API calls. Developers can also leverage the payment system by embedding iFrame on the website. This option takes less time to integrate.

Choosing The Correct Product

For online transactions, a payment gateway is essential. Customers can make their purchase and process the payment easily, and companies can receive the payment hassle-free through this gateway. While selecting the right payment gateway provider, assess the adaptability of the payment solution into your business. You can also hire an expert who will help you to choose the best payment gateway.

Make Your Customers Feel Safe And Secure

It is crucial to give the customers a sense of security while making online transactions. This is important for customer satisfaction and retention. Your customer will expect your e-Commerce website to provide a secure payment option to minimize the payment risk. You need to ensure that your payment gateway provider is certified for various information security standards like PCI-DSS.

Consider Fees And Service Agreement Requirements

Check the compatibility of the protocols of the service provider with your company standards. This will reduce the chances of any inconsistency in business sales, revenue system, transaction frequency, and the markets served.

Ensure Effective Transactions

Your payment gateway in the e-Commerce platform should not have unwanted form fields. Most of the customers cancel the transaction if they are required to fill up multiple forms to complete the process. The payment gateway provider should enable a simpler checkout process for the customers. It is important to eliminate redundancies to provide an efficient payment gateway.

Make Checkout Easy on All Devices

By 2021, mobile e-commerce sales are expected to account for 54% of total e-commerce sales. When you are evaluating your payment gateway options, ensure that the checkout experience is receptive to various mobile devices, and different network types.

Multiple Features to Choose From

The payment gateway solution should adhere to your business needs. Your provider should extend global solutions and should enable the gateway to accept several credit cards, debit cards, and currencies. The payment gateway should be able to support electronic invoicing, different payment types, text/email reminders for customers, and other efficient management strategies.

Easy Integration Process

Integrating the payment gateway to your e-commerce platform should be easy. The User Experience Design of the platform should enhance the usability, accessibility, and efficiency of the process of making the payment.

Merchant Account

Your payment gateway should have a merchant account to receive the funds. The customer’s money will be temporarily transferred to a separate retailer account. It will stay there until it is approved by the customer’s processing bank. This improves the security aspect of the transaction and improves fund management.

Recurring Billing

Subscription-based services can be powered with a recurrent billing model. An automatic billing cycle enables the companies to collect money from regular contributors in a consistent manner. Your payment gateway can enable the recurring billing option to bill customers with subscriptions or invoices. This simplifies the payment process for your customers and ensures timely payments.

To Conclude:

An online payment gateway helps the organization to accept several types of electronic payment easily. With the help of the tips mentioned above, you can choose the right online payment gateway provider to authorize the payments for your e-businesses securely.