The Hammer is the name used for a separate candle chart pattern that is a bullish inversion signal. Its name originates from the way that it outwardly resembles a hammer. As the short body of the candle, is on the head of a long wick (shadow). Many traders accept for it to be substantially the lower wick that makes the handle must be the size of the upper body. The body must be on the head of the wick with a level top and next to no however ideally no upper wick.

Hammer Candlestick Pattern

The hammer is the candlestick pattern of the bullish reversal candlestick pattern that consists of one of the candles that appears after the downtrend. The candle is formed similar to the hammer that simply shows the long lower wick and the short body at the top of the candlestick with almost no upper wick. In the present scenario, the variety of ECN Forex Broker offers a trading platform with full automation.

The Hammer candlestick pattern is made when the open, high, and close are with the end goal that the genuine body is little. Additionally, you can locate a long lower shadow, multiple times the length as the real body. It should look simply like a capital ‘T’. This means the chance of a Hammer candle.

How Hammer Candlestick Pattern Form?

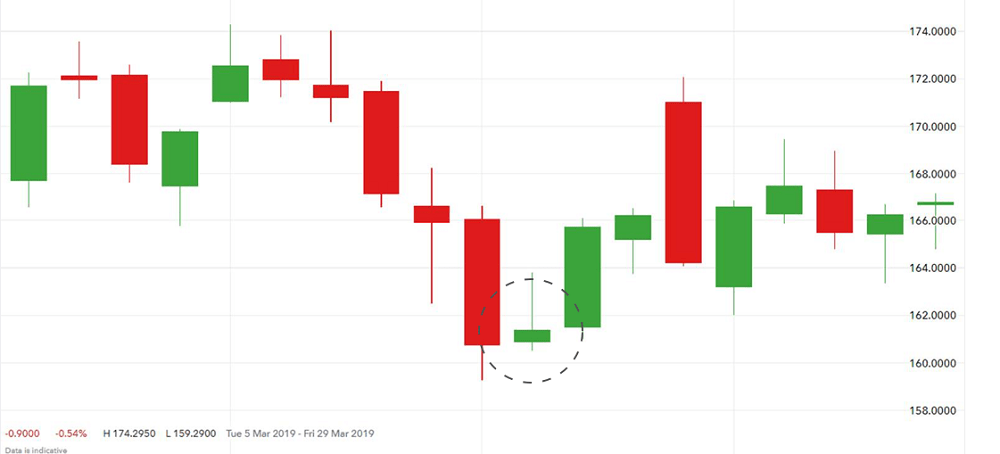

Hammer candle is framed when a market price moves prominently lower than the initial price yet recovers in the day to close above or near the actual price. The bigger the lower shadow, the more huge the candle becomes.

Hammer can be found at a particular time period candle chart. The bigger the time period chart, the more thorough the hammer candle will be, because of the more features included.

The Hammer is an amazingly providing candle example to help traders apparently observe where support and request are found. After a downtrend, the Hammer can motion toward brokers that the downtrend could be finished and that short positions might be secured.

Inverted Hammer Candlestick Pattern

The Inverted hammer is a kind of candle chart found after a downtrend and is typically taken to be a pattern reversal pattern. The reversed hammer seems as though an upside-down form of the hammer candle chart, and when it shows up in an upturn is known as a shooting star.

The Inverted candle pattern is made of the candle with a little lower body and a long upper wick which is multiple times as extensive as the short lower body. The body of the candle should be at the low finish of the trading reach and there will be next to lower wick in the candlestick.

The long upper wick of the candle pattern shows that the buyers pushed prices up eventually during the period wherein the candle was shaped, yet experienced selling pressure which drove prices down to close approach to where they opened. While experiencing a reversed hammer, traders regularly check for a higher open and close on the following time frame to approve it as a bullish pattern. One of the most powerful MT4 and MT5 trading platforms now have all types of charts with fast order execution. You can easily MT4 Free Download from our website to boost your trading experience.

Hanging Man Candlestick Pattern

The bearish pattern of the Hammer is the Hanging Man formation. A hanging man is a kind of bearish inversion chart, comprised of only one candle, found in an upturn, and can go about as a notice of a potential inversion descending.

The Hanging Man candlestick pattern, like the Hammer, is framed when the open, high, and close are with the end goal that the genuine body is short. Also, there is a long lower shadow, which ought to be multiple times more noteworthy than the length of the genuine body. The Hanging Man chart shows pattern shortcoming and shows a bearish inversion. Hanging man examples can be more handily saw in intraday outlines than every day charts. In the event that this example is found toward the finish of a downtrend, it is commonly known as a “hammer”.