Introduction

Microsoft ERP solutions improve the business whether your business can benefit from management system or do it really need to automate its processes. Microsoft Dynamics ERP solutions resolve issues with failure to provide deliverables on time, like scope creep, personality conflicts.

For businesses to grow well in the modern environment, they need to transform, and transformation takes time. The employers that require employees to grow without creating time for the innovation process will likely be disappointed by the outcomes. The best potential opportunity for financial management software vendors experts is to purchase sensible automation and other latest technologies.

Microsoft dynamics 365 Finance and operations

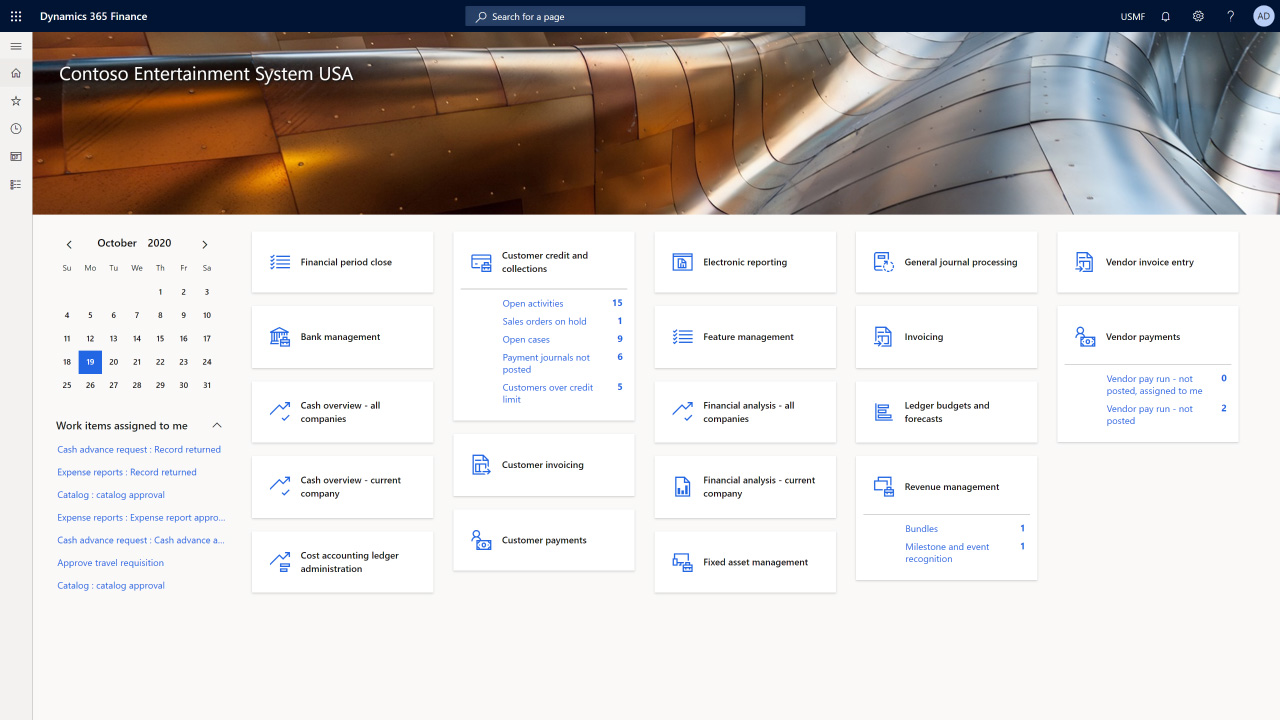

Dynamics 365 Finance is a financial management set that facilitates enterprise organizations to monitor the performance of their worldwide financial operations in real-time, forecast future outcomes, and make data-driven choices to drive development. If your organization is looking for ways to leverage automation and AI, Dynamics 365 Finance can assist to merge your data and systematize your business processes.

Dynamics 365 Finance can facilitate your business to improve productivity and feature with AI-infused finance processes.

How Microsoft Dynamics 365 Finance and operations streamline financial processes.

Microsoft Dynamics 365 Finance and Operations is reliable and its domain authority by revealing just what you need to know to be fluent and ready for any Microsoft Dynamics 365 for Finance and Operations challenge.

Maximize financial visibility and profitability

Dynamics 365 functions facilitate financial management software vendors and organizations to control financial threats and reduce deception, This ERP system is helpful to move away from transactional financial management to implement analytical and practical operations that help to determine performance, protect returns, and take better care of their individuals.

Enhance your financial decision making

Evaluate the condition of your company, enhance financial mechanisms, and make timely assessments to handle responsiveness and growth using comprehensive, real-time financial reporting, embedded analytics, and AI-driven insights.

Combine and systematize business methods

Incorporate financials into essential business procedures and systematize manual and time-spending responsibilities to increase user efficiency, encourage evolving business models, and maximize financial implementation.

Planned effects and decrease expenses

Reduce expenses and enhance expenditures across business characteristics with process mechanization, budget control, and financial planning and assessment.

Decrease global financial complexity and risk

Quickly revise to change financial and legal obligations with a managed, rules-based chart of accounts and a no-code configuration facility that streamline monitory reporting, electronic invoicing, and global expenses

Optimize financial operations

Organizations enhance financial operations with AI-powered concepts and rooted analytics, and by automating old versioned and time-consuming activities. Financial Officer in various businesses reviews the cash flow forecast in Dynamics 365 Financeto analyze the organization’s upcoming cash requirements for coffee bean shipments.

Protect your revenue

Dynamics 365 Fraud Protection (DFP) protects revenue and restrain fraud by utilizing AI models to convert evaluations into results.

It DFP has three key competencies: Purchase Protection, Loss Prevention, and Account Protection.

Encounter growing potentials in the technological world

Microsoft Dynamics 365 Finance is assisting prominent businesses and developing their ways for revolution in their business processes.

As enterprises complications increases, organizations gradually change to their senior finance leaders for planned direction and to run business renovation. Chief financial officers (CFOs) play substantial roles in corporations’ transformation struggles, and the transformations need enlarged assistance from finance.

Take advantage of emerging technologies

To know the challenges of contemporary business, many finance units are transforming to emerging technologies, such as intelligent automation, AI, and machine learning, to improve and modernize business processes, enhance accuracy.

Much of finance operations can be entirely or partially automated using currently available machineries. It observes that leaders’ who embrace rising technologies to computerize finance operations can be substantial assets in their organizations to focus on planned leadership and improvement.

Considering AI’s reported and prospective advantages alongside its lower approved rate, the case can be made that finance leaders who control this technology now can do more than free up time for team members to focus on revolution. They can also generate a strategic advantage for their organization in the short period.

With so much to increase, let’s look at a few specific good examples of where businesses can influence AI to increase efficiency and enhance competitive advantage.

Accounts receivable

Financial management software vendors find it difficult to calculate when a customer will pay their invoices. This condition can start to less accurate cash flow estimates, and orders released to customers who may fail to pay on their expense.

Compounding the problem is the fact that cash collection is usually a sensitive procedure. All too often, managers are trapped with rising receivables and instruction manual data entry. That’s why many people are still pulling statistics from their enterprise resource planning (ERP) into Excel spreadsheets

In Microsoft Dynamics 365 Finance USA, it’s now feasible to develop a calculation model to control accounts receivable with AI-driven machineries. In this case, AI model forecasts that which customers are likely to pay on time, which are not, and even provides a space of error to consider. Leveraging an automated, AI-based calculation model also means more time for employees to focus on higher-level trouble resolving, scheduling, or customer service.

Consumers are improving financial processes with Dynamics 365 Finance – A customer Story.

Bel Fuse designs, manufactures, and markets electronic circuits products at 24 manufacturing locations across North America, Europe, and Asia. The company’s existing enterprise resource planning solution was highly customized and expensive to maintain, so it decided to deploy Microsoft Dynamics 365 Finance and Dynamics 365 Supply Chain Management. Working together, Dynamics 365 Finance, Project Operations, and Fraud Protection assist businesses to improve their financial operations, adapt quickly and reduce costs, and protect their income.