Refinancing your student loans has the potential to streamline your debt repayment while also saving you money. However, it is not the best option for all borrowers, and some may have difficulty qualifying. We contacted financial professionals for their best student debt refinancing ideas to learn more about the benefits and drawbacks.

Save money on interest payments.

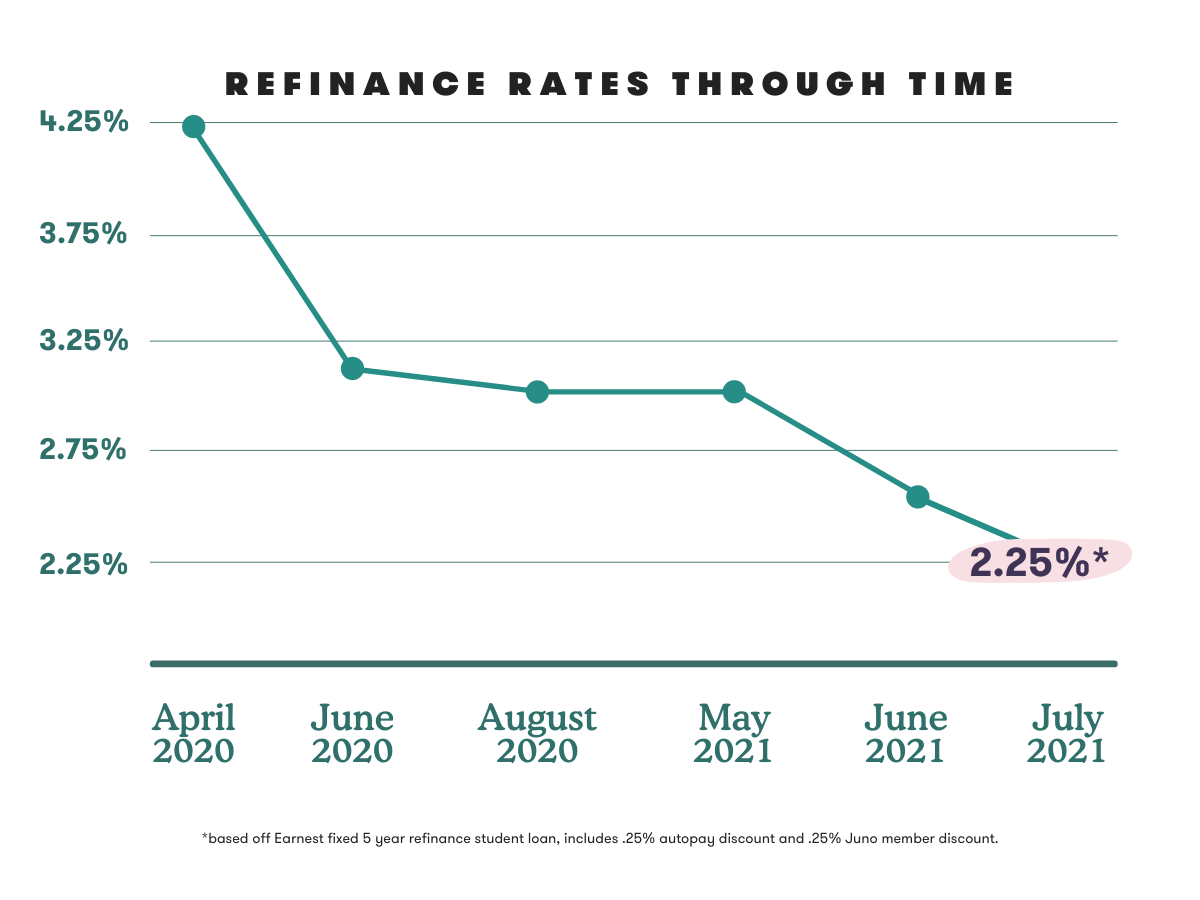

A lower interest rate is one of the most significant advantages of refinancing student loans. If you can fulfill the credit and income standards — or if you apply with a cosigner who can — you might be able to get a low-interest rate on your student loan refinance .

“Getting a reduced interest rate by refinancing may save thousands of dollars,” says Travis Hornsby, a certified financial analyst, and creator of Student Loan Planner.

Assume you had a $30,000 student loan with a 6.80% interest rate and a 10-year payback period. You’d save $4,119 in interest over ten years if you refinanced that rate down to 4.50 percent.

You could not only set away from the money you save on interest each month, but you could also apply it to your student debt to pay it off even faster.

Don’t be fooled by loan promises.

Although decreasing your interest rate might save you money, you must be careful not to be duped by a lender’s inflated promises. Some lenders may promise to be able to save you hundreds of dollars, but the math only works if you select a certain repayment period and make a specified monthly payment.

According to Mark Kantrowitz, editor and vice president of research at Savingforcollege.com, “lender marketing about savings may not match the reality of individual borrowers.” “Even if the savings are substantial, the majority of them will come from a shorter repayment period and greater monthly payment, not the reduced interest rate.”

If you increased your monthly payment, for example, you might pay off your debt in half the time – refinancing or not.

“You may simply adopt a larger monthly payment on your own, without refinancing,” Kantrowitz explains, “by making extra principal payments.”

Although refinancing for a lower rate may increase your savings, you must first determine whether refinancing is the best option for you.

Look around for the best deals.

One of the most significant student loan refinancing recommendations to consider if your objective is to discover the lowest interest rate is this: Before deciding on a lender, compare offers from a number of different lenders.

Although evaluating various offers may appear to be time-consuming, it is not. Some lenders provide immediate rate quotations, allowing you to obtain an idea of your rate with only a few pieces of personal information.

Furthermore, these rate offers have no impact on your credit score and require no commitment. So, if you’re wondering if you’ll qualify, lenders like SoFi, CommonBond, and Earnest can tell you in a matter of minutes.

Take caution not to jeopardize your federal advantages.

Student debt refinancing is available for both private and government student loans. When you refinance federal student loans, however, you lose access to government repayment plans, forgiveness programs, and other benefits. Private lenders aren’t always as accommodating as the federal government, which offers a range of choices to assist you to get through times of financial trouble, such as the student loan moratorium during the coronavirus outbreak. Some, but not all, enable you to defer student loan payments through forbearance if you leave your employment or return to school.

Refinancing your federal student loans would be a terrible choice if you expect to require government programs in the future — or if you’re working toward a program like Public Service Loan Forgiveness.

Even if you’re willing to forego government safeguards, check to discover what benefits your prospective refinancing provider provides before committing to that lender. Some lenders, for example, provide consumers with unemployment insurance and even job coaching.