Who does not wish to make the right choices and earn a good amount of money when investing their money in brokerage firms? It becomes possible only if you choose the right broker. Selecting the right broker and handing it over certain decisions about your money is an immense risk than the investment itself. You put all your trust in them and hope to pull out your money whenever you are getting a good payback.

Consider this broker review to get some insight on brokers. All your strategies and plans will mean nothing if the broker deceives you and gets away with all the interests. Let me get you through some key points and tricks to choose the right broker.

Tips for choosing a broker:

Choosing the right broker is not a piece of cake when you have a lot of options available. But you can terminate this headache if you analyze things correctly by following the tips discussed below:

Security and reliability:

The first and foremost thing you should see in a broker is a high-security level. If it is unable to provide surety of security, it is not worth your money and time. But there is good news. You can figure out if the broker is a fraud or reliable easily. Just check if the firm is registered in a regulatory agency or not. Different countries have different regulatory agencies. If the broker is its member, then you can trust it. This little effort saves you from a lot of risks.

Untroubled depositing and withdrawing:

The broker has no right to refrain you from depositing or withdrawing your money. Only you have the right to take this action. If the broker causes any trouble or hurdles, then your money is not in safe hands. The purpose of a broker is to make the trading process easier for you. He should deal with the hurdle if there is any and make the process of depositing and drawing easy for you.

Check out the reviews:

When you have selected a broker, check out its reviews. But you have to be careful about it. There can be both positive and negative fake reviews. Sometimes the people do not want to take the blame for their mistakes and manipulate the broker by giving fake negative reviews. Check the review credibility and use common logic to assess the information published as reviews.

Keep away from free bonuses:

Sometimes the firms offer free bonuses if you deposit some money in their account. Nobody wants to face loss by giving free bonuses. They have their benefits behind it. If you deposit the money, they pull out their interest at every withdrawal. Before signing up for a broker, send them an email to elude you from any bonus offerings.

Take a demo personally:

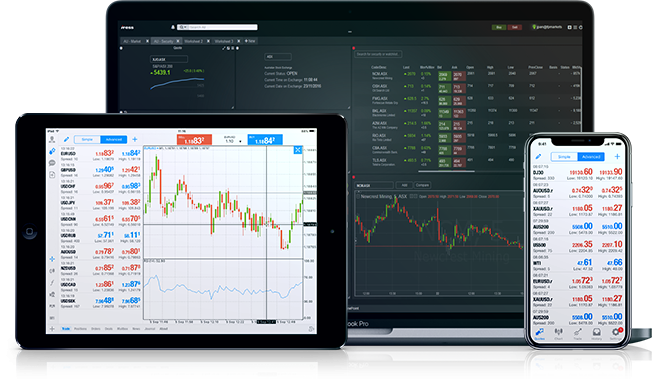

You can check the credibility of a broker by creating a demo account. Check the trading regulations and go through each step by investing a small amount of money. This way, you will be able to get an experience of a broker, making it easy for you to decide if it is worth a large investment or not.