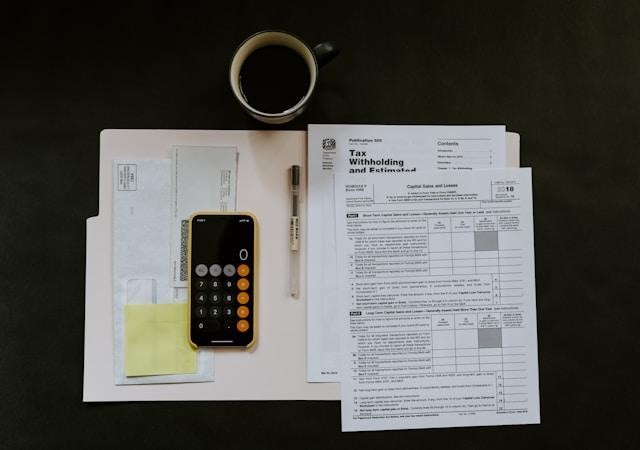

If you are an entrepreneur running any size of business or a decision maker in your organization, you know the struggle in finding new customers and retaining the existing ones. Along with that, maintaining cash flow, accurate financial reporting, business taxes, and compliance are paramount.

This article takes you through the five most critical signs that indicate the necessity of collaborating with professional accounting services. Though your business growth would have been excellent, accounting should not be a hurdle to your progress.

Financial management requires adequate knowledge, expertise, and experience in maintaining and finalizing statements under compliance norms.

When Should You Hire an Accounting Partner?

Let’s dive into the five red tags showing the necessity of collaborating with an accounting partner:

1. Are You Starting or Expanding Your Business?

If you are a startup or a small business in its growing stage, your company may not be able to afford a full-fledged team of accountants and financial managers. Similarly, when planning an expansion, you prefer to spend most of your time on marketing and administrative operations to help your team adapt to the change.

If you neglect accounting-related tasks, things may pile up and make it challenging to meet the deadlines of tax return submissions and more. Even if you divide your working hours, sparing adequate time for accounts-related matters, you may lose crucial working time you should have given to your core competencies.

2. Do You Notice that Your Business is Unable to Handle Cashflow?

Are you effectively managing a positive cash flow and anticipating your expenses? If you are failing to manage cash flow, you may experience inadequate finances for working capital, missed vendor payments, employee salaries, and other operational expenses.

It’s time to collaborate with an accounting partner to establish workflows, ensure timely payments and loan repayments, and maintain a positive cash flow, which implies excellent financial health for your organization.

3. Difficulties in Understanding Business Taxes and Compliance?

Your C-Suite may include excellent technologists, technocrats, and know your business from the inside out. However, grasping technicalities related to business taxes and compliance with regulations enforced by concerned authorities (Internal Revenue Service, IRS in the US) sometimes requires a significant learning curve.

Stop spending your valuable time studying taxation updates and compliance standards. If you are doing so, you need an accounting partner to take care of these significant financial aspects.

4. Struggling to Maintain Accurate Financial Reporting?

Are you ensuring the timely submission of financial reports? It is a crucial requirement to avoid further surprises. Entrepreneurs and executives with a technical or non-commercial background may not be well-versed in maintaining accounts and preparing financial reports.

Financial reporting and timely analysis are crucial to determining the performance of your business. Expert accounting partners not only maintain accounts and prepare reports but also help you gain actionable insights from their financial analysis.

5. Not Sure if Your Business is Ready for an Audit?

Is your organization ready for the challenging ordeal called an ‘audit’? IRS regulates the taxes and collection in the US. The institution analyzes and exposes your business’s financial history, aiming to identify discrepancies, and if found, your company may need to face the consequences.

SMSF outsourcing services manage the administration, accounting, and auditing of a self-managed superannuation fund. Partnering with them can bring a great deal of peace of mind for your business.

Summing Up

The article takes you through the five most significant red flags indicating your business needs professional accounting services. Let the experts handle your accounts, and help you free up more time for product development, marketing, or your core business activities.

Expect more accurate bookkeeping, financial reporting, timely submission of tax returns, and complete peace of mind by working with a reputable accounting partner.

FAQs

Q 1: What is an accounting partner?

Ans: It is a third-party provider of accounting, financial reporting, taxation, and compliance-related services.

Q 2: What does an accounting partner do?

Ans: An accounting partner maintains accounts, prepares financial reports, submits tax returns, and conducts economic analysis for its clients.

Q 3: How to choose the right accounting partner?

Ans: Work with a reputable accounting service with adequate experience and expertise in managing accounts, financial reporting, and taxation for businesses of various sizes and natures.

Q 4: How much may an accounting partner cost?

Ans: The pricing for accounting services varies based on your specific business needs. Contact your potential accounting service to get a quote.