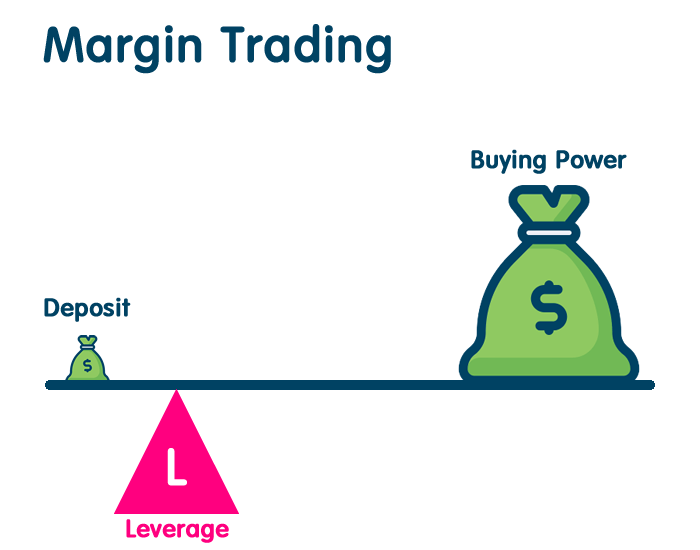

Margin refers to money that an investor has to deposit with the broker in order to cover the credit risk from the broker. This means that margin trading allows investors to net off borrowing with the capital invested in the margin trading account. This amount will be provided by brokers as a balance amount against this margin so that investors can take bigger positions than what their current investments otherwise would allow. This service is available for specific stocks only, which qualify those stocks under the eligibility criteria set by the exchange.

Step 1: Choose Registered Broker

Select a broker duly registered with SEBI to provide a margin trading facility. Not all brokers do this, and features as well as charges and eligibility stock lists may differ. Check the terms and conditions regarding margin requirements, interest rates, and allowed leverage. This is critical for ensuring regulatory compliance and a sound platform.

Step 2: Open Trading and Demat Account

Setting up a margin trading account usually requires setting up a trading account and a demat account: the trading account is for orders, while the demat account is for holding purchased securities.

Step 3: Activate Margin Trading Facility

This usually consists of a separate agreement and documentation after opening all necessary accounts. While some brokers offer this service electronically with an e-signature, others may require that individuals submit some documents physically. There may also be a possible assessment of one’s income or trading history by brokers as an eligibility check.

Step 4: Transfer Amount for Margin

The first place you have to transfer at least a minimum amount to the broker’s account before entering the trade on margin in the stock market. This margin can be money or approved securities, or partly both. The percentages apply to the stock and the policies of the broker. Please ensure that the margin is sufficient to avoid any shortfall or penalty.

Step 5: Make a Margin Trade

Now that you have activated the margin trading facility, you must deposit the requisite margin amount. After that, you can place orders against the margin product the broker has made available to clients. Margin option would usually show during order entry, while it could also bar you from placing trades in stocks listed by the exchange and broker. The other paramount aspect is that you should monitor this in real-time with reasonable exposure and margin usage.

Step 6: Monitor Margin Requirements

Your portfolio decreases in value on account of the swings of the market. All margin trades are marked to market every day by the brokers. If the value of the portfolio falls, they are also liable to call for additional margin. Provision is therefore needed to fund such a call; otherwise, the position is forcibly squared off at the end of the day. Regular monitoring will, however, put you in a better condition to mitigate these incidents, as it serves as a great risk management tool.

Step 7: Close or Carry Forward the Position

You could close your position by selling the shares or carry it forward with the stipulated margin that one has to maintain. Should the margin fall below the maintenance level, a top-up is needed. Carrying forward a position may also attract interest on the borrowed amount. So, please ensure that you are aware of the cost structure in prolonged holding.

Step 8: Check Broker Statements and Disclosures

Statements are delivered periodically by Brokers, describing the volume of margin used, interest charged, and the position held. Scan these for actual and updated compliance. Understanding these statements is extremely crucial for reconciling trades, tracking profits or losses, and confirming fulfillment of all regulatory norms.

Step 9: At the End of the Month, Withdraw from the Margin Trading Facility

If you do not want to continue the margin trading facility, you can withdraw the dues and give notice to the broker. Your account will revert to normal trading mode. Any collateral pledged by you will be unpledged by the broker’s policies and exchange regulations.

Conclusion

Thus, it has a clear process, right from choosing a broker through to opening accounts, depositing margin funds, and doing responsible trades: those who enter margin trading into the process usually are young professionals.