The financial industry cannot ignore the digital revolution happening right before our eyes. However, there is already a name for innovation and the rate of change in this field: fintech, which, according to PWC, is viewed as a guarantee of revenue development by 60% of global enterprises and is expected to surpass $305 trillion in value by 2025.

FinTech has disrupted the traditional banking and financial sector by providing creative solutions and alternatives to its services. Below, we’ll tackle fintech and its impact on credit scores.

What Is FinTech?

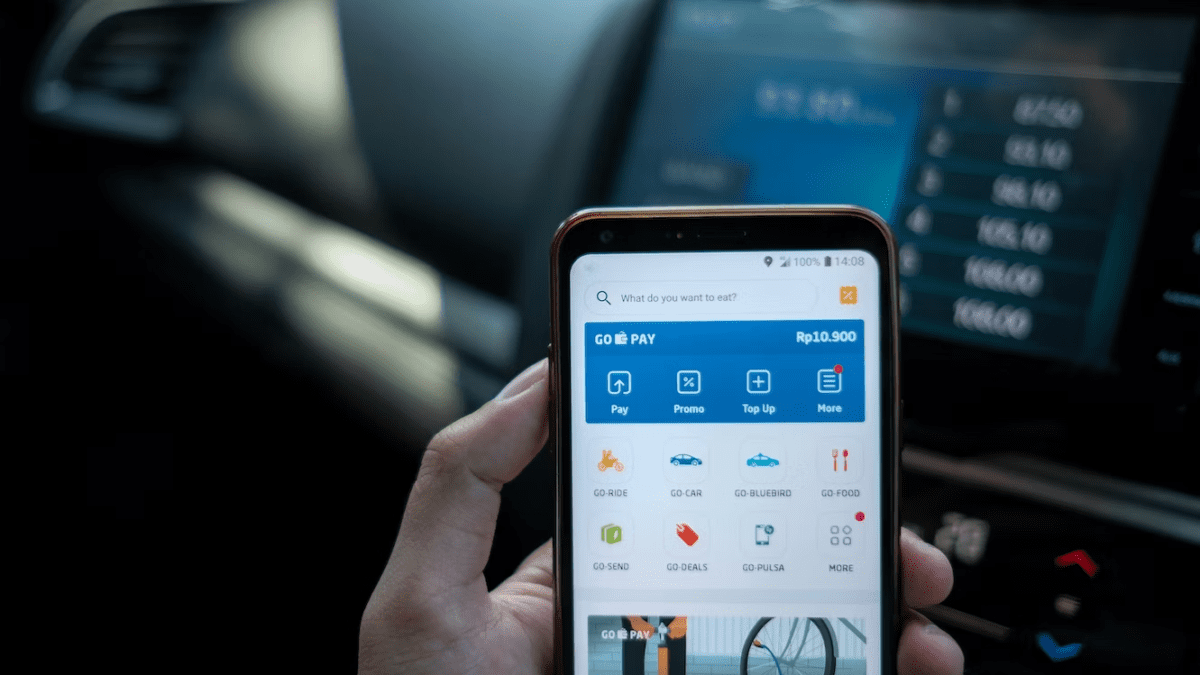

FinTech has developed extraordinarily quickly during the past ten years and is a special fusion of financial services and technology. It is essential to digital payments, digital commerce, and mobile POS (which uses digital payment technologies to process payments offline).

With the help of fintech, you can boost digital sales income, promote data-driven decision-making, and streamline teamwork. The driving factor behind the industry’s development is the need for more functionality from transaction systems by clients, who increasingly anticipate straightforward, practical, and convenient solutions that enable efficient management of their financial resources.

The Impact of FinTech on Credit Scores

It is no secret that FinTech helped improve credit scoring systems. It has made it possible to assess a borrower’s creditworthiness using different data sources. FinTech lenders also consider aspects like social media activity, online shopping habits, and even education and employment history when evaluating borrowers, unlike traditional banks, which traditionally base their decisions on credit ratings and income.

How Does FinTech Significantly Influence Other Financial Aspects

Like all other innovations, fintech has risks, like security risks. But we cannot ignore that it has disrupted the traditional credit and lending business by providing creative solutions and alternatives to conventional banks and financial institutions. Here are some of the significant effects of fintech on other financial aspects.

Online Lending Platforms

Through FinTech, online lending platforms have taken off, enabling borrowers to apply for loans online without physically contacting a bank or a lender. These platforms use algorithms to assess borrowers’ creditworthiness and provide affordable loans.

Peer-to-Peer (P2P) Lending

P2P lending is another well-liked type of FinTech financing. It makes it possible for people to lend and borrow money from one another without using conventional financial institutions. P2P platforms link lenders and borrowers so lenders can profit from their investments by providing loans to borrowers.

Microloans

Microloans are small loans often provided to individuals or small businesses, and fintech has enabled their emergence. Microloans are frequently used to finance new businesses, provide working capital, or fund specific initiatives.

Digital Wallets and Payment Platforms

FinTech has also facilitated the development of these tools, which let people and businesses send and receive money online. In addition to providing quick and secure payment choices, these platforms can lower transaction costs.

The Advantages of FinTech in the Modern Era

Seamless Financial Services

The existence of fintech will make various financial services quicker and simpler. One advantage of fintech for customers is the speed with which financial transactions, including payments, may be made.

Helping Entrepreneurs Obtaining Business Capital

Providing business capital to entrepreneurs is one of the advantages of fintech in modern society. Fintech makes it easier and more effective to obtain the required funding. Finding the necessary potential investors is also made simpler.

Adding Reference Loans With Low Interest

Expanding loan options for consumers, particularly business owners who may want loan money to expand their operations, is also an advantage of fintech.

Fintech has made it possible to obtain loans in a broader range of ways, each with its benefits and drawbacks. Additionally, business people will profit from reduced interest rates, making it more straightforward to repay their loans whenever they are due.

Supporting a Better Standard of Living

As was already said, fintech contributes to raising the community’s standard of living. The economy will grow more quickly the more financial activity there is. It aids in the improvement of the community’s welfare and economic standing. As a result, fintech’s contribution to a more wealthy society is significant.

Reduce Operational Expenses

Fintech typically charges less per transaction than other traditional banking services. In this approach, the community’s or users’ operational expenses are reduced, which results in better cost savings.

Flexibility in Financial Activity

All financial transactions were formerly conducted offline, but they are now entirely possible online, thanks to fintech. It entails that people can complete financial transactions without limitations from any location, giving every community the freedom to conduct specific financial transactions.

Bottom Line

FinTech has made a big difference in the credit and lending sector by providing cutting-edge solutions and alternatives to conventional banks and financial institutions.